39 calculating tax math worksheets

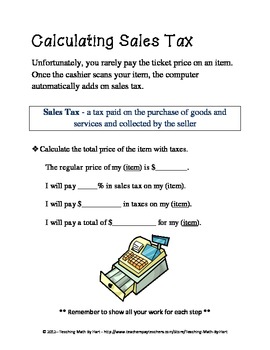

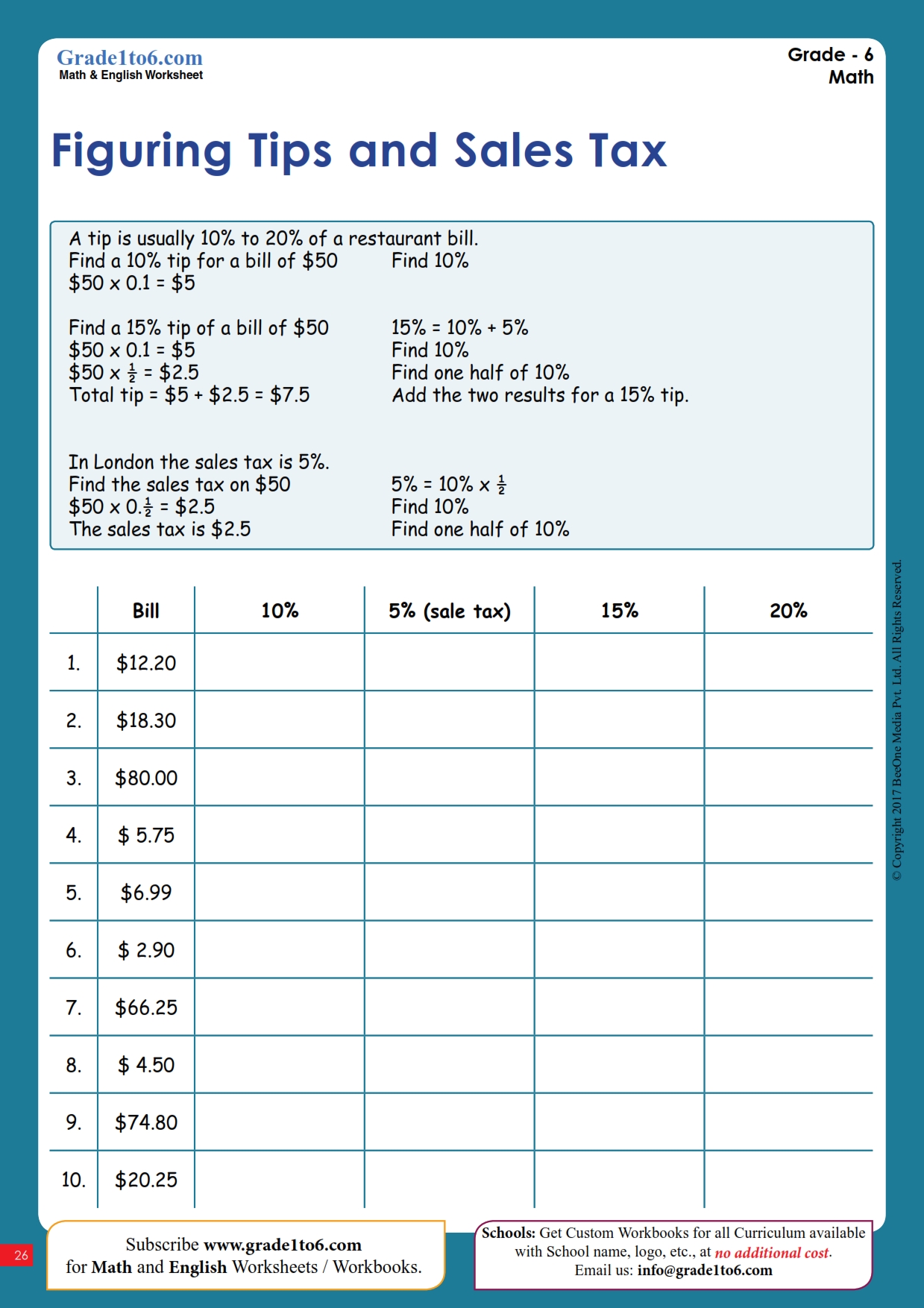

Taxes Lesson Plans, Income Tax Worksheets, Teaching Activities A basic worksheet to help teach young students the concept of paying taxes while practicing basic math. SALES TAX Discount and Sales Tax Lesson Plan Students learn about sales tax and discounts. Lesson includes changing percents and calculating total cost. Includes a teaching lesson plan, lesson, and worksheet. Sales Tax Introduction (Level 1) calculating tax worksheet commission worksheet sales commissions calculations quiz study stair structure step calculate explain answer. Tax, Simple Interest, Markups, And Mark Downs . math worksheet interest simple grade tax worksheets problems word 7th sales downs mark markups met purchase standard. Profit And Loss Worksheet briefencounters.ca

› resources › lessonsAlgebra Help - Calculators, Lessons, and Worksheets - Wyzant ... Need to practice a new type of problem? We have tons of problems in the Worksheets section. You can compare your answers against the answer key and even see step-by-step solutions for each problem. Browse the list of worksheets to get started… Still need help after using our algebra resources? Connect with algebra tutors and math tutors ...

Calculating tax math worksheets

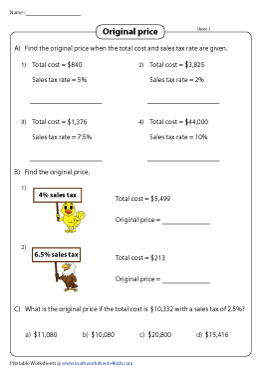

› lessons › percentCalculating Percentage Increase And Decrease - Math Goodies Learn About Calculating Percent Increase And Decrease With The Following Examples And Interactive Exercises. Example 1: Ann works in a supermarket for $10.00 per hour. If her pay is increased to $12.00, then what is her percent increase in pay? Sales Tax - FREE Math Lessons & Math Worksheets from Math Goodies Answer: The sales tax is $1949.35 and the total cost is $29,990.00 + $1949.35 = $31,939.35. As you can see, for small purchases, sales tax can be a nuisance; whereas for large purchases, sales tax can be a significant amount. Let's look at an example in which the sales tax rate is unknown. PDF Discount, Tax and Tip - Effortless Math Math Worksheets Name: _____ Date: _____ … So Much More Online! ... The sales tax in Texas is 8.25% and an item costs $400. How much is the tax? $_____ 18) The price of a table at Best Buy is $220. If the sales tax is 6%, what is the final price of the table including tax? $_____ ...

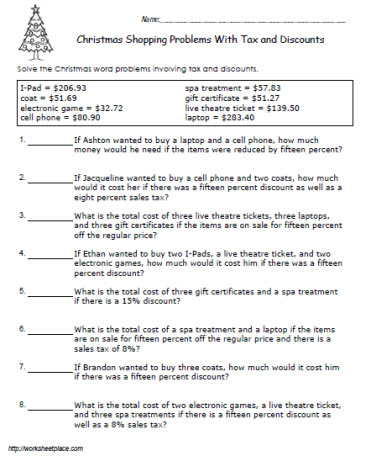

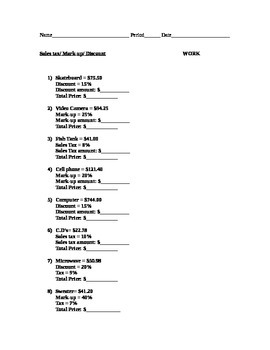

Calculating tax math worksheets. Applying Taxes and Discounts - WorksheetWorks.com Create a worksheet: Find the price of an item after tax and discount. Applying Taxes and Discounts Using Percentages. Find the price of an item after tax and discount. These problems ask students to find the final price of various items after discounts and taxes are applied. ... Calculating Tax Worksheet Teaching Resources | Teachers Pay Teachers This resource is great for students who need practice calculating tax, gratuity and discounts from word problems. Problems include scenarios where students are given a total amount of a bill, tax and gratuity percent, and students need to calculate the final amount. Students should know which to calculate first, second, and so on… Consumer Math Worksheets | Printable Free Online PDFs Consumer math is one of the most fundamental concepts from a mathematics point of view. It is defined as a branch of mathematics that uses basic math skills in real-life situations like shopping, calculating taxes, estimating monthly budget, calculating interest rate for a loan, etc. Calculating simple and compound interests, profit and loss etc. all come under this category. › retirement-plans › self-employedSelf-Employed Individuals – Calculating Your Own Retirement ... Nov 05, 2021 · the deductible portion of your SE tax from your Form 1040 return, Schedule 1, on the line for deductible part of self-employment tax, and; the amount of your own (not your employees’) retirement plan contribution from your Form 1040 return, Schedule 1, on the line for self-employed SEP, SIMPLE, and qualified plans.

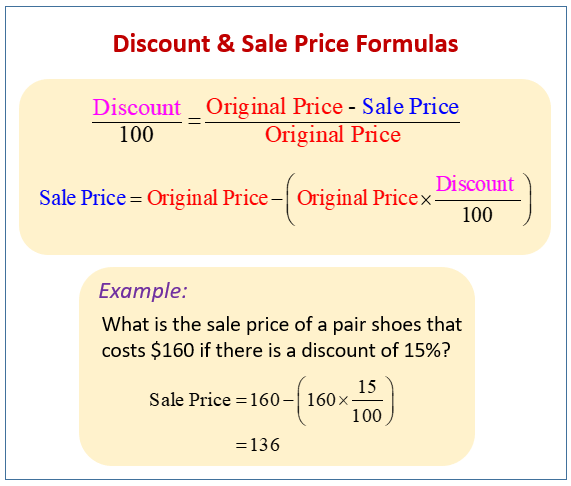

Property Tax Calculations and Prorations Math Worksheet This video takes students through a DETAILED explanation of how to calculate property taxes using T Bar formulas. There are multiple examples and all are wo... Quiz & Worksheet - How to Calculate Property Taxes | Study.com Print Worksheet 1. A house has an assessed value of $250,000. The local government has a tax rate of $75 per $1,000 for calculating the property tax. What is the property tax? $20,000 $18,750... › lessons › percentHow To Calculate Discount and Sale Price - Math Goodies Once again, you could calculate the discount and sale price using mental math. Let's look at another way of calculating the sale price of an item. Below is a modified version of the problem from the top of this page. Example 5: In a video store, a DVD that sells for $15 is marked, "10% off." What is the sale price of the DVD? Quiz & Worksheet - Calculating Taxes & Discounts | Study.com Instructions: Choose an answer and hit 'next'. You will receive your score and answers at the end. question 1 of 3 The listed price of a dress is $59.99. If the tax is 8%, what is the total cost?...

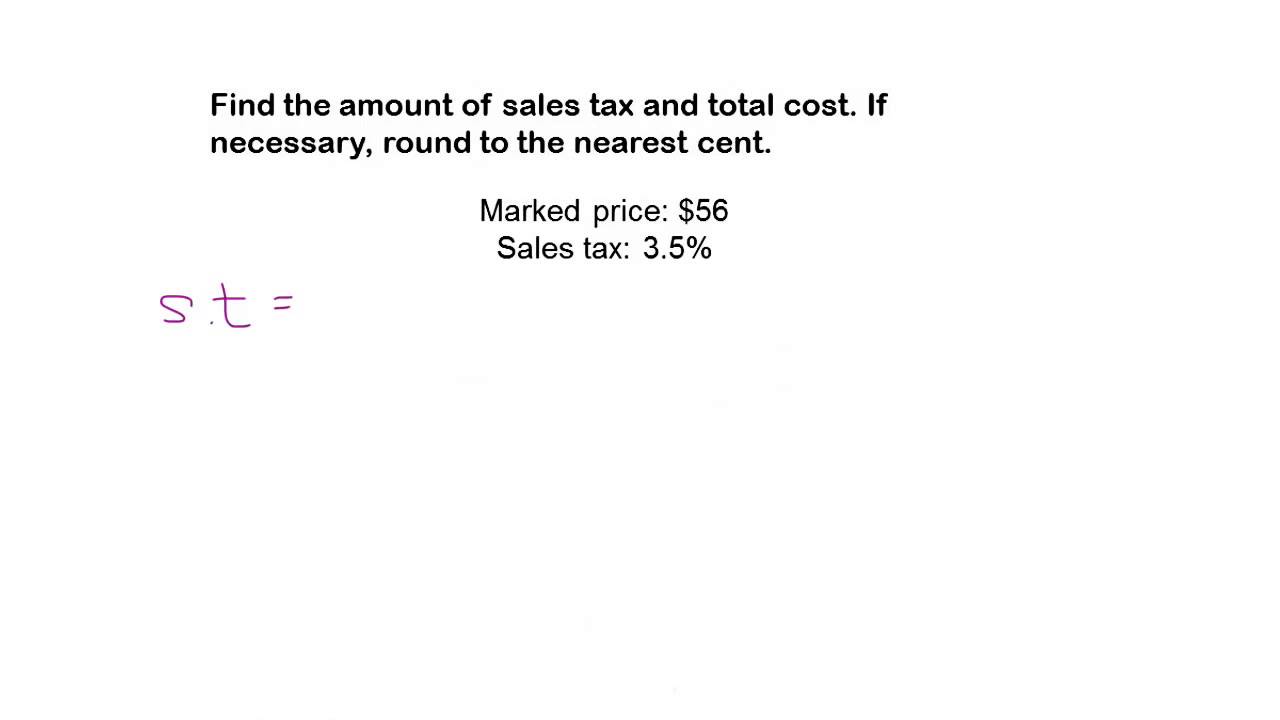

How to calculate taxes and discounts | Basic Concept ... - Cuemath The formula used to calculate tax on the selling price is given below: Tax amount = $(S.P.× T ax rate 100) $ ( S. P. × T a x r a t e 100) Let's consider an example. Let's say an item costs $50, and a sales tax of 5% was charged. What would be the bill amount? Let's first find 5% of 50. 5/100×50 = 2.5 › geometry › quadrilateralsTrapezoid Bases, Legs, Angles and Area, The Rules and Formulas A trapezoid is a quadrilateral with one pair of parallel lines. Bases - The two parallel lines are called the bases.. The Legs - The two non parallel lines are the legs. Adding Taxes Using Percentages - WorksheetWorks.com Create a worksheet: Find the price of an item including taxes calculating tax worksheet Self-Employed 401k Contribution Worksheet Free Download. 8 Images about Self-Employed 401k Contribution Worksheet Free Download : Calculating Tax Tip And Commission Practice Worksheet Answers - Tax Walls, Markup, Discount, and Tax (Harder) Worksheet for 8th - 9th Grade and also Self-Employed 401k Contribution Worksheet Free Download.

Income Tax worksheet - Liveworksheets.com Income Tax Calculating income tax and money received after deductions. ID: 1342388 Language: English School subject: Math Grade/level: Secondary ... More Math interactive worksheets. Matching Number Name to Numbers (1-10) by khosang: Addition DJ by CPSGradeOne: Place Value by Gierszewski: Mixed Times Table

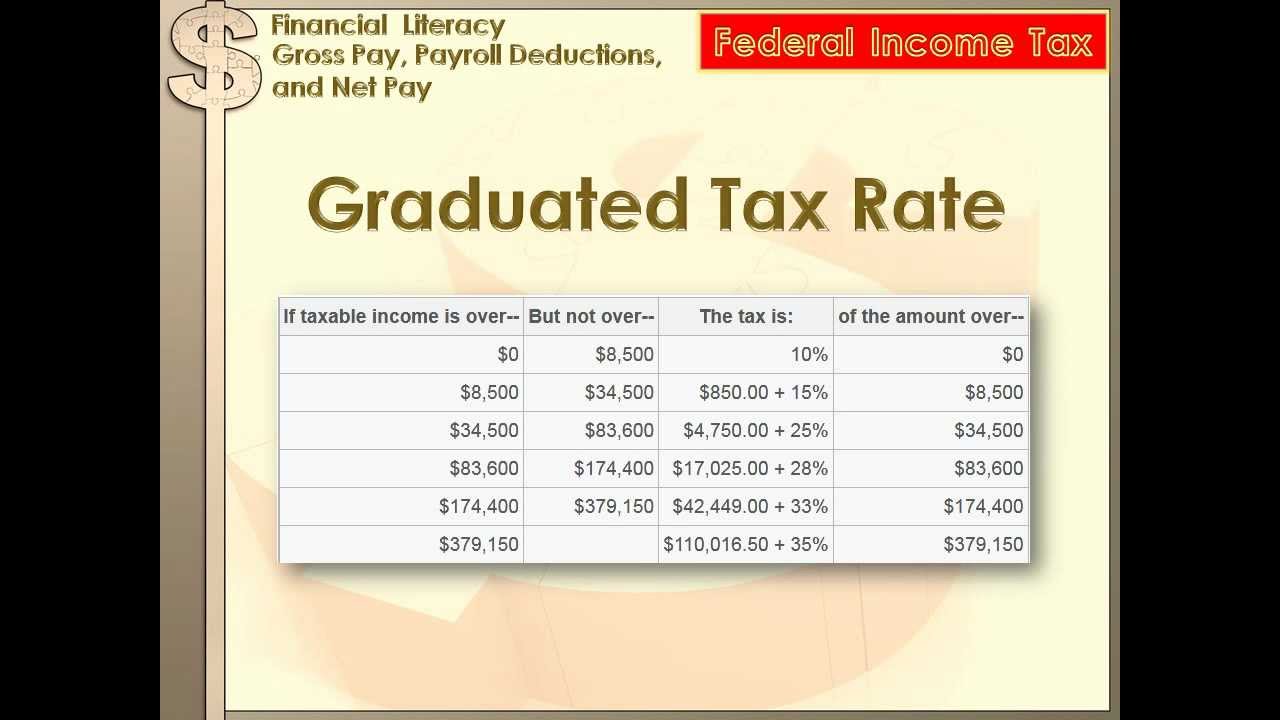

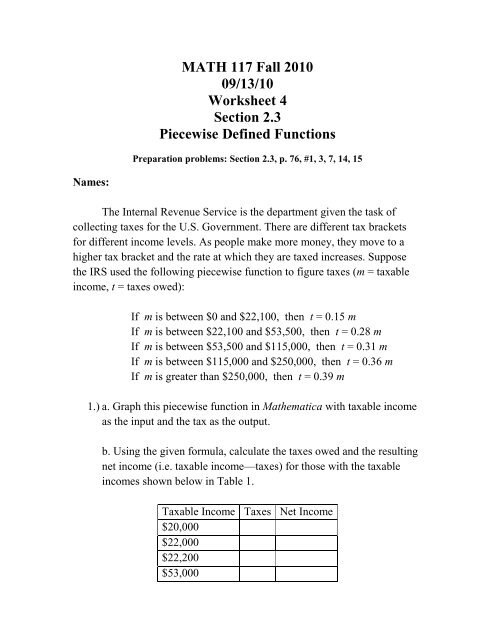

PDF Lesson 3 v2 - TreasuryDirect tax. 6. calculate tax rates (percents) and the dollar amount of taxes. 7. read and understand tax tables. Mathematics Concepts computation and application of percents and decimals, using and applying data in tables, reasoning and problem solving with multi-step problems Personal Finance Concepts income, saving, taxes, gross income, net income ...

Calculating Total Cost after Sales Tax worksheet ID: 839531 Language: English School subject: Math Grade/level: Grade 5 Age: 7-15 Main content: Percentage Other contents: Sales Tax Add to my workbooks (35) Download file pdf Embed in my website or blog Add to Google Classroom

PDF Math Tax Worksheet - christianperspective.net Math Tax Worksheet This worksheet is designed to give you a simplified look at filling out a 1040 U.S. Individual Income Tax Return. ... E. Calculate your Adjusted Gross Income—how much you made after the allowable deductions—by subtracting what you wrote on line 36 (the deductions) from what you wrote on line 22 (the total ...

Money Worksheets With Tax | Teachers Pay Teachers Money Worksheets Add Subtract Next Dollar Up and Sales Tax Distance Learning by Carol Bell - Saved By A Bell 7 $12.00 $9.60 Bundle Zip PRINT & GO! 4 Weeks of skills practice in Adding Money, Next Dollar Up, Finding Change & Calculating Sales Tax with prompts on each page reminding kids how to execute each skill.

Discount Worksheets - Math Worksheets 4 Kids Here's the formula: discount percent = discount amount ÷ marked price x 100. Finding Selling Price or Marked Price Using Discount Percent What is the marked price if the selling price is $86 after a discount of 6% is applied? Experience the ease of finding the sale price or marked price in this section of our calculating discount worksheets.

› sales-taxSales Tax Worksheets - Math Worksheets 4 Kids Find the sales tax and calculate the total cost of the items using these 3-part printable worksheets! Finding the Original Price If the sale price is $460 and the sales tax rate is 4%, what is the original price? All there's to do is to substitute the values in the appropriate formula and proceed to solve for the missing values.

How to Find Discount, Tax, and Tip? (+FREE Worksheet!) - Effortless Math Step by step guide to solve Discount, Tax, and Tip problems. Discount = = Multiply the regular price by the rate of discount. Selling price = = original price - - discount. Tax: To find tax, multiply the tax rate to the taxable amount (income, property value, etc.) Tip: To find tip, multiply the rate to the selling price.

Calculating Sales Tax | Worksheet | Education.com Catered to fifth-grade students, this math worksheet shows kids the steps to find the amount something costs with tax. This process uses decimal numbers, rounding, and division. Students practice what they learn in both straightforward calculations and in word problems. Download Worksheet See in a set (11) View answers Add to collection

› consumer-mathConsumer Math - Basic-mathematics.com Real state tax Learn how a property tax is calculated using some basic math skills. Topics in investment Bonds Learn about what bond, face value, and how to calculate the cost of bond given the face value and the percent shown on the face value.

PDF Discount, Tax and Tip - Effortless Math Math Worksheets Name: _____ Date: _____ … So Much More Online! ... The sales tax in Texas is 8.25% and an item costs $400. How much is the tax? $_____ 18) The price of a table at Best Buy is $220. If the sales tax is 6%, what is the final price of the table including tax? $_____ ...

Sales Tax - FREE Math Lessons & Math Worksheets from Math Goodies Answer: The sales tax is $1949.35 and the total cost is $29,990.00 + $1949.35 = $31,939.35. As you can see, for small purchases, sales tax can be a nuisance; whereas for large purchases, sales tax can be a significant amount. Let's look at an example in which the sales tax rate is unknown.

› lessons › percentCalculating Percentage Increase And Decrease - Math Goodies Learn About Calculating Percent Increase And Decrease With The Following Examples And Interactive Exercises. Example 1: Ann works in a supermarket for $10.00 per hour. If her pay is increased to $12.00, then what is her percent increase in pay?

![Free GED Math Worksheets [Updated for 2022]](https://cdn.effortlessmath.com/wp-content/uploads/2019/09/GED-Math-worksheet-cover.jpg)

0 Response to "39 calculating tax math worksheets"

Post a Comment